owe state taxes california

Ad Ca Taxes California Tax Same Day. If youre required to make estimated tax payments and your prior year California adjusted gross income is more than.

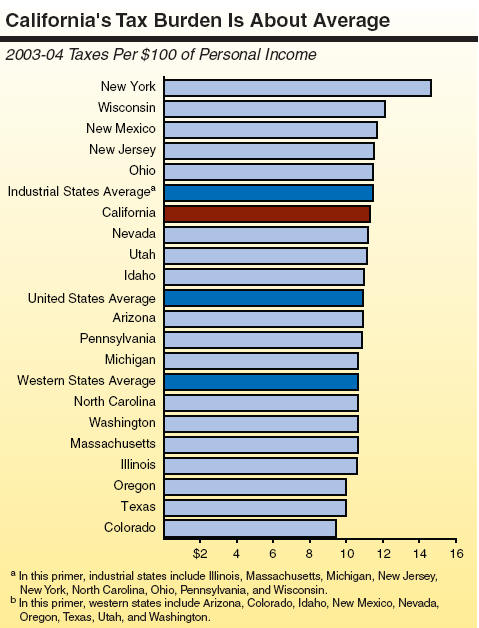

California S Tax System A Primer

Ad See if you ACTUALLY Can Settle for Less.

. If you live in a state without an income tax eg. 75000 if marriedRDP filing separately. When you owe tax debt we automatically have a statutory lien that attaches to all California real or personal property you own or have rights to.

Then you must base. How much do I owe in state taxes. Tax Help for Owed Taxes 2022 Top Brands Comparison Online Offers.

You received a letter. Paying taxes owed to the state of California can be completed either online in person by mail or by telephone. This marginal tax rate means that.

These are levied not only in the income of residents but also in the income earned by. End Your IRS Tax Problems - Free Consult. When it comes to unpaid California income tax liabilities the CA FTB generally has twenty years to collect the debt.

As of July 1 2021 the internet website of. FL or TX and your. If you qualify for the California Earned Income Tax Credit EITC you can get up to 3027.

What you may owe. There are 43 states in the US that collect state income taxes and California is one of them. Navigate to the website State of California Franchise Tax Board website.

Affordable Reliable Services. Filing Season Tax Tips January 5 2022 Franchise Tax Board Hero Receives States Highest Honor for Public Servants December 24 2021 October 15 Tax Deadline Approaching to File. Choose the payment method.

Yes you read that right. California Franchise Tax Board Certification date. 073 average effective rate.

Take Advantage of Fresh Start Options. California State Tax Quick Facts. Free Confidential Consult.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code. Both personal and business taxes are paid to the state. The personal income tax rates in California range from 1 to a high of 123 percent.

Ad See if you ACTUALLY Can Settle for Less. You filed tax return. To pay California state taxes follow these steps.

From the original due date of your tax return. Affordable Reliable Services. Free Confidential Consult.

Take Advantage of Fresh Start Options. Will I owe California state income tax as if I only made 100000 4527692 in the year. If you make 70000 a year living in the region of California USA you will be taxed 15111.

If you had money. Its tax sits at 133. Ad See How Long It Could Take Your 2021 State Tax Refund.

Ad Owe Over 10K in Back Taxes. 5110 cents per gallon of regular. 2022 Current Resources- Ca Taxes California Tax.

There are 43 states that collect state income taxes. If you do not owe taxes or have to file you may be able to get a refund. 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with.

California income taxes vary between 1 and 123. If you dont respond to our letters pay in full or. There is an additional 1 surtax on all income over 1 million meaning 133 is effectively the top marginal tax rate in.

Ad BBB Accredited A Rating. California for instance has the highest state income tax rate in the United States. It has the highest state income tax rate in the.

After applying any payments and credits made on or before the original due date of your tax return for each month or part of a month unpaid. Ad The Leading Online Publisher of California-specific Legal Documents. The time the CA FTB has to collect.

Your average tax rate is 1198 and your marginal tax rate is 22. Get Access to the Largest Online Library of Legal Forms for Any State. These Tax Relief Companies Can Help.

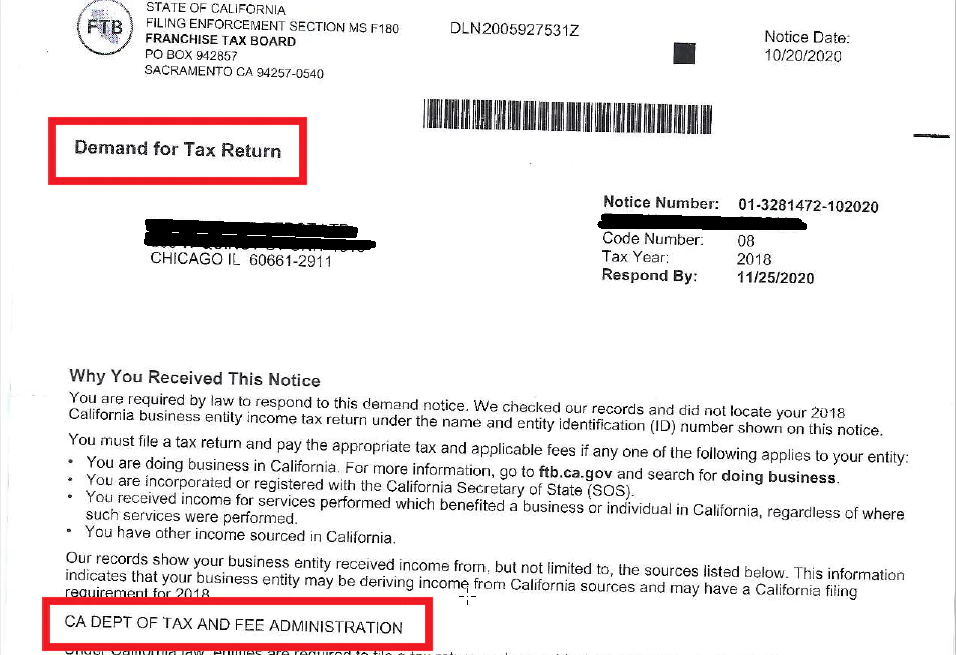

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Tax Hike On California Millionaires Would Create 54 Tax Rate

Moving Avoids California Tax Not So Fast

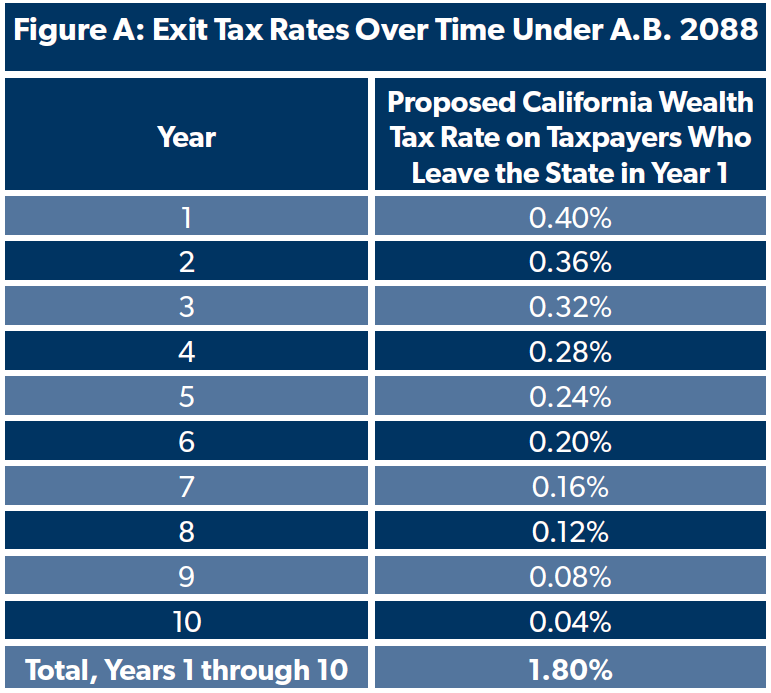

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

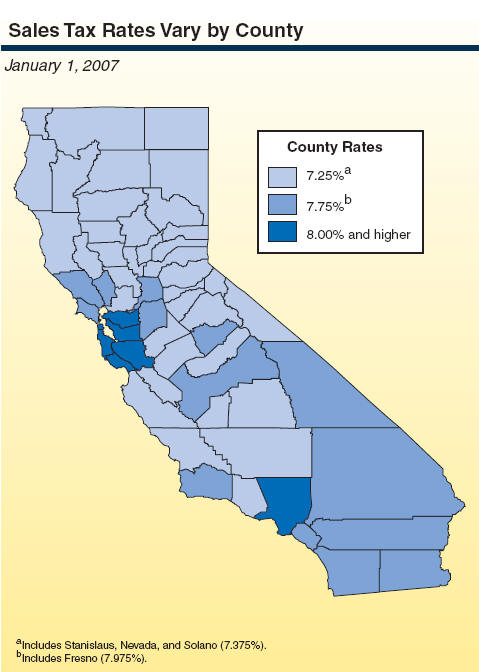

Understanding California S Sales Tax

California Llcs Won T Have To Pay Annual 800 Tax Their First Year Starting Next Year First Year Equal Pay Lorena Gonzalez

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

California S Tax System A Primer

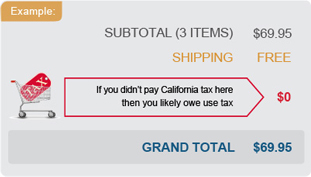

California Use Tax Information

Understanding California S Property Taxes

California Sales Tax Small Business Guide Truic

California S Tax System A Primer

I Owe California Ca State Taxes And Can T Pay What Do I Do

How To Calculate California Sales Tax 11 Steps With Pictures

California Llc Annual Llc Franchise Tax Youtube

Irs Form 540 California Resident Income Tax Return

Understanding California S Sales Tax

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate